Intel Q2/2025 Financial Report - Iron Discipline and the Repositioning War

Lip-Bu Tan's financial discipline replaced the ambitious IDM 2.0 strategy of Pat Gelsinger - the previous CEO of Intel.

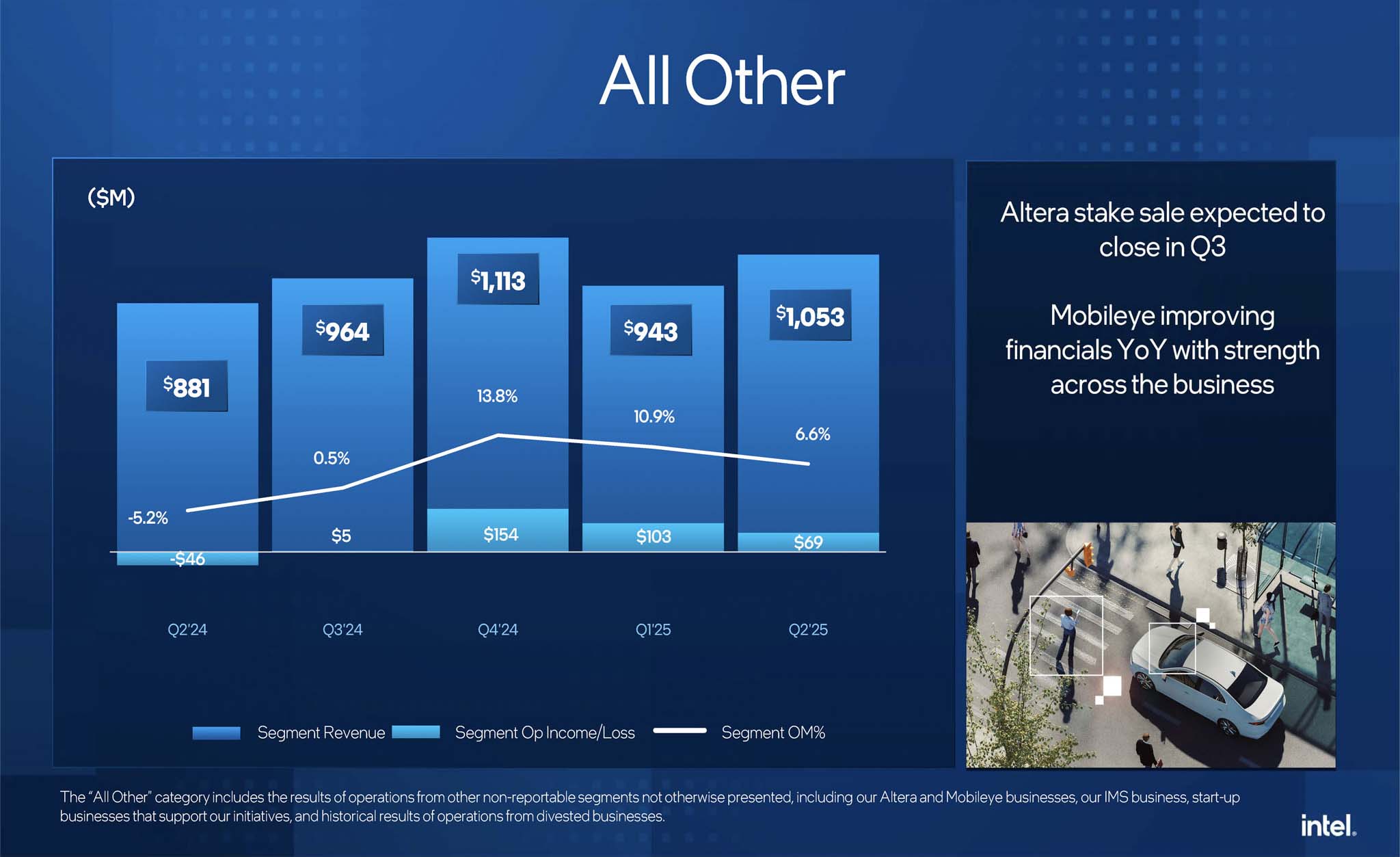

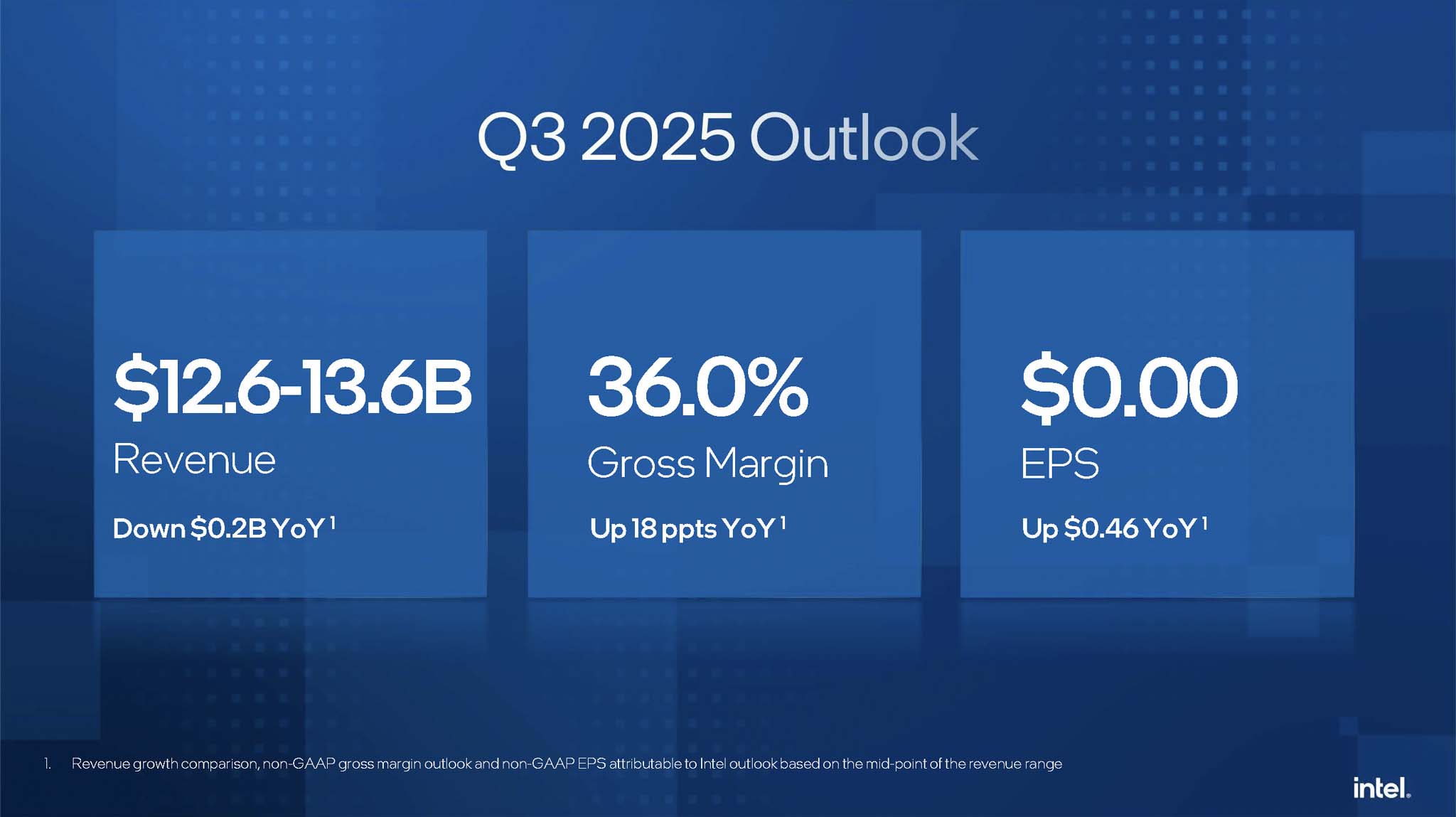

Intel’s Q2 2025 financial report shows a painful but necessary and decisive transition period under CEO Lip-Bu Tan. The big picture is flat revenue, no profit, a net loss (according to GAAP) of $2.9 billion and a gross profit margin of 27.5%. From canceling a billion-dollar European factory project, tightening capital spending to restructuring personnel, the decisions were made to stabilize the situation. In that context, Intel still faces competitive challenges: AMD increases pressure in the data center segment, while NVIDIA maintains near-absolute dominance in the AI market. With the goal of breaking even on a non-GAAP basis, the forecast for Q3 2025 continues to be a difficult road for Intel.

Article content

Intel Q2/2025 Financial Report

Revenue and profit

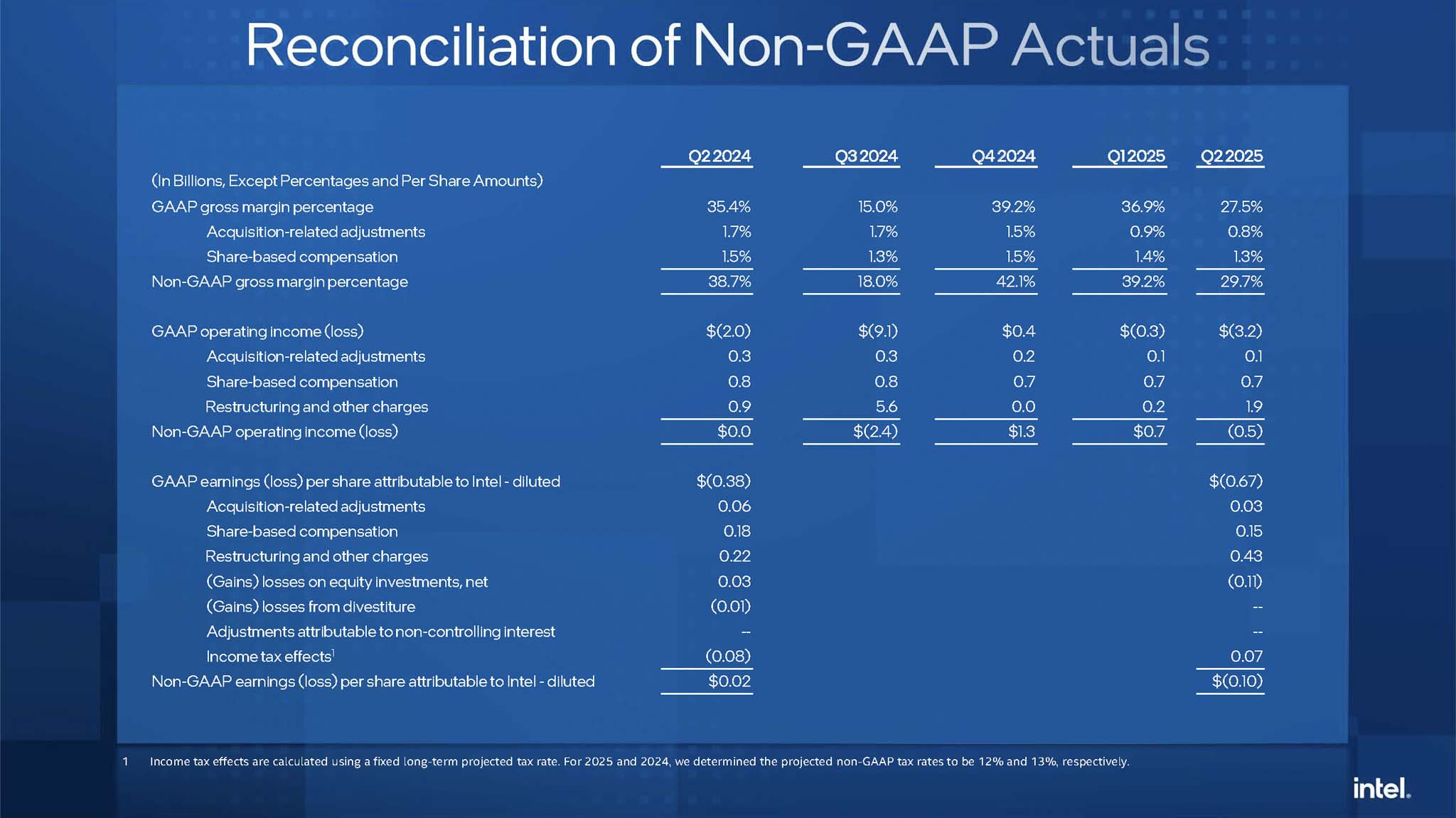

In Q2 2025, Intel reported revenue of $12.9 billion – virtually unchanged from $12.8 billion in the same period in 2024. The revenue slowdown has had a serious impact on the bottom line. Intel reported a GAAP net loss of $2.9 billion, equivalent to a loss per share (EPS) of $0.67. This result represents a complete reversal from Q2 2023’s profit of $1.5 billion (EPS $0.35) and a significant decline from Q2 2024’s loss of $1.6 billion (EPS $0.38).

Even after removing the anomalies, the picture is still not bright. Non-GAAP earnings also recorded a loss of $0.4 billion, with EPS of $0.10, compared to a modest non-GAAP profit of $0.1 billion (EPS of $0.02) in the same period last year. The declines across all profit metrics suggest that Intel’s problems are not just temporary, but are deeply rooted in its cost structure and operating efficiency.

Unusual charges

The extraordinary charges led to a massive GAAP loss. A $1.9 billion restructuring charge and an $800 million impairment charge hit the bottom line. Together, they accounted for $2.7 billion of the GAAP loss, illustrating the scale of the drastic measures CEO Lip-Bu Tan is taking to clean up the balance sheet.

In particular, an $800 million impairment charge was recorded for excess equipment with an undetermined reuse purpose. This is the clearest example of the consequences of excessive and inefficient capital expenditure (CapEx) in the previous period, when Intel pursued a strategy of massive production expansion without adequate assurance from market demand.

Margin crisis

Intel's financial health is not good, as shown by its profit margin. GAAP Gross Margin has dropped to an alarming 27.5%, down 7.9% from 35.4% in Q2/2024. Similarly, GAAP Operating Margin is negative 24.7%, down sharply from 15.3% in the same period last year.

This result is not only due to environmental factors but is a direct and predictable consequence of the IDM 2.0 strategy. In pursuing the goal of 5 nodes in 4 years (5N4Y), Intel was forced to invest heavily in new factories and technologies. Processes such as Intel 3 and Intel 4, when they first came into operation, had very high initial production costs and suboptimal performance. At the same time, market demand could not keep up with the expansion rate, leading to factories operating at unused capacity, creating a huge fixed cost burden. CFO David Zinsner had warned of margin pressure from accelerating AI PC products and the impact of unused capacity as early as Q2/2024, a situation that has worsened in Q2/2025. The new Internal Foundry model, which will be implemented from early 2024, will further expose this huge manufacturing cost instead of hiding it in the overall cost of product segments as before.

Business segment details

Client Computing Group (CCG)

Intel’s mainstay PC business (CCG) had revenue of $7.9 billion, down slightly by 3% year-over-year. The results were disappointing when compared to the 9% growth seen in Q2 2024, when the PC market began to recover and the AI PC wave created high expectations. While Intel remains the leader in AI PC shipments, far outpacing its competitors combined, the revenue decline suggests a slowdown. Either consumers and businesses are not seeing enough value from AI PCs to drive a major upgrade cycle, or the overall PC market remains fragile in the face of macroeconomic pressures.

Data Center and AI (DCAI)

The Data Center and Artificial Intelligence (DCAI) segment was a bright spot with revenue of $3.9 billion, up 4% from Q2 2024. This modest growth reversed a 3% decline from the same period last year, thanks to the arrival of new generations of Xeon processors such as Sierra Forest and Granite Rapids. However, the 4% growth is too small compared to the explosive pace of the global AI market. While competitors are reporting triple-digit growth, DCAI is still struggling to regain its position. This is also the business segment that Intel is most worried about.

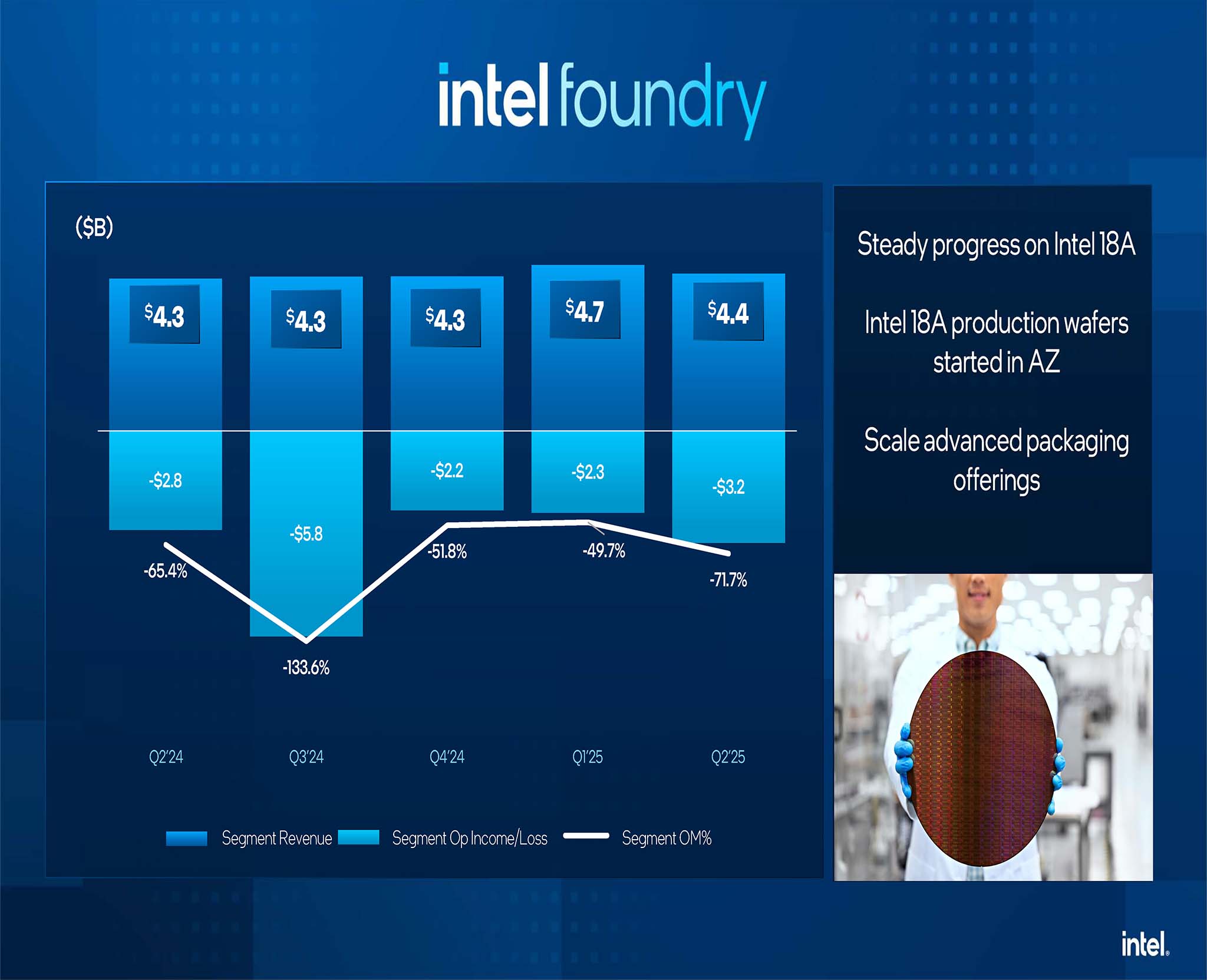

Intel Foundry

The semiconductor manufacturing business (Intel Foundry) had revenue of $4.4 billion, up 3% compared to Q2/2024. Under the new financial reporting model applied from 2024, Intel Foundry revenue includes wafer sales to Intel's internal product divisions (Intel Products) and to external customers.

This 3% growth masks a more complex reality. Intel Products’ total revenue (which includes CCG and DCAI) actually declined 1% in the quarter. This suggests that Intel’s own internal wafer demand is not likely to be a strong growth driver for Foundry. Foundry has yet to be successful in attracting meaningful, large contracts from external customers. CEO Lip-Bu Tan has decided that future 14A investments will only be made if there is a confirmed customer commitment. This suggests that large external contracts are not yet solid enough to justify costly expansions. Currently, Intel Foundry appears to be operating more as a cost center than a profit center, with growth still heavily dependent on “in-house” sources.

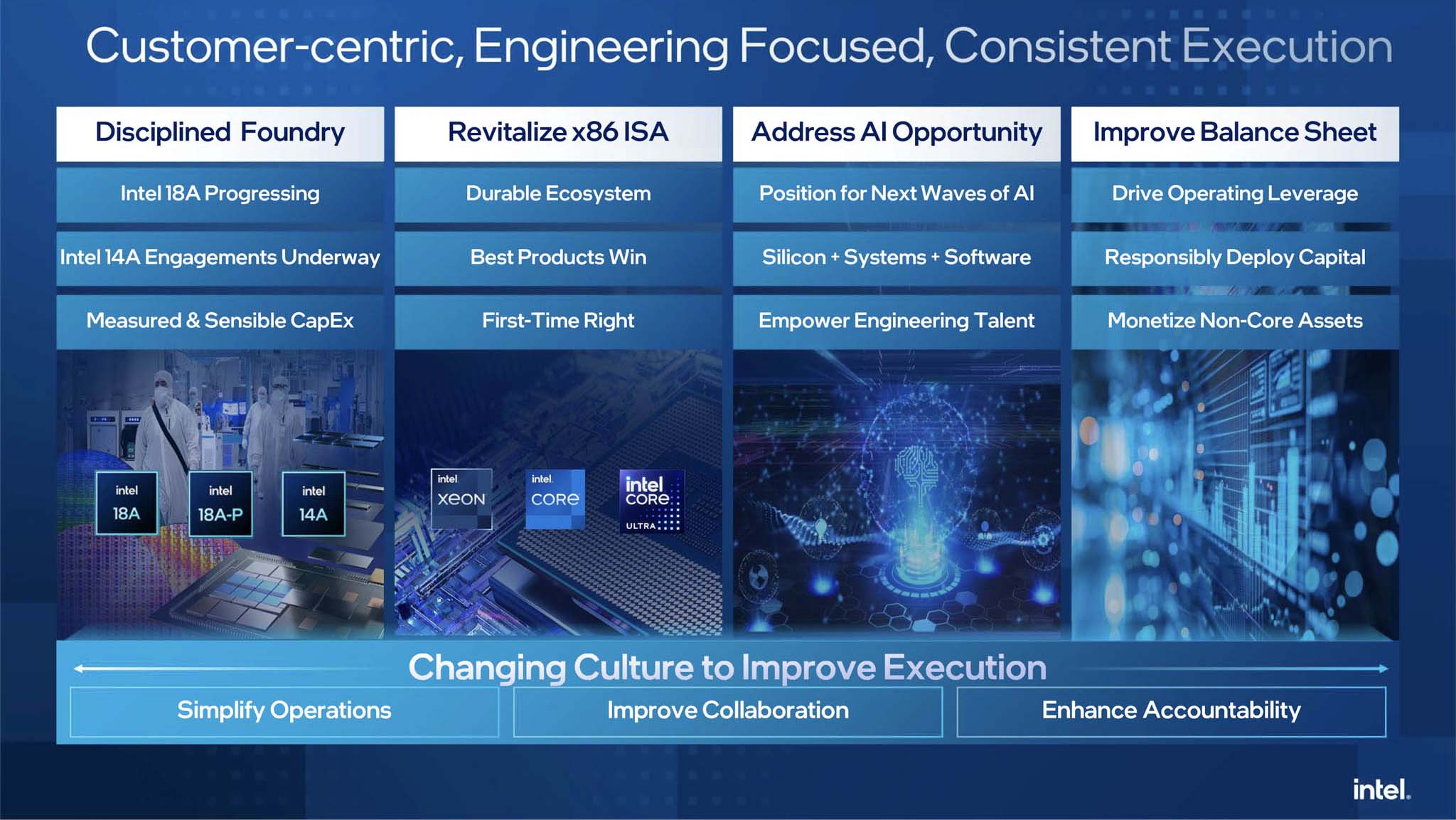

Lip-Bu Tan and Financial Discipline

CEO Lip-Bu Tan has signaled a radical shift in Intel's operating philosophy. His statement in the Q2/2025 report outlined the new priorities:

“We are laser-focused on strengthening our core product portfolio and AI roadmap… We are also taking the necessary actions to build a more financially disciplined foundry business.”

This is in stark contrast to the philosophy of his predecessor Pat Gelsinger, who staked Intel’s future on regaining technological leadership at all costs, as demonstrated by the IDM 2.0 strategy and the “5 nodes in 4 years” goal. Intel’s focus has shifted from “technology leadership” to “financial efficiency.”

The new financial discipline doctrine that Lip-Bu Tan applied is not just empty words, it has been materialized through drastic actions in recent times:

- Operating Expenses (OpEx) Reduction: GAAP Research & Development (R&D) and Marketing, Sales & General Administration (MG&A) expenses decreased 13% year-over-year in Q2 2025, from $5.6 billion to $4.8 billion. The goal is to reduce total non-GAAP operating expenses to $17 billion by 2025 and further to $16 billion by 2026.

- Tightening capital expenditures (CapEx): Intel targets gross capital expenditures of $18 billion for 2025. This is a significant cut from the expected $25-27 billion for 2024.

- Project cancellations and delays: One of the boldest decisions was to cancel chip factory construction projects in Germany and Polandand to slow down construction in Ohio.

- Restructuring: Intel is completing a plan to cut more than 15% of its workforce, equivalent to about 15,000 jobs, that was announced by 2024.

More than just cutting costs, the new CEO is repositioning his strategy defensively. By canceling projects in Europe, Intel implicitly acknowledged that it could not shoulder the ambition of an autonomous semiconductor supply chain for the West on its own, a goal that was also promoted by the CHIPS laws in the US and Europe. Instead of investing up front and taking financial risks, Intel is shifting the burden back to governments and customers. In essence, Intel is sending a clear message: “If you want a local supply chain, you have to pay for it.”

Semiconductor battlefield

Data Center Wars (vs. AMD)

While Intel’s DCAI revenue grew just 4% to $3.9 billion in Q2 2025, rival AMD reported a 115% increase in Data Center revenue in Q2 2024 to $2.8 billion. Market reports from late 2024 and early 2025 consistently showed AMD surpassing Intel in data center revenue for several quarters, while gradually capturing about a third of the server CPU revenue market share. Intel is on the defensive in a long-term battle that no longer holds the upper hand as before.

The AI Race (vs. NVIDIA)

If the battle with AMD is tough, the confrontation with NVIDIA in the AI field is a difference in class. NVIDIA's Data Center revenue in the most recent quarter reached a record $ 26.3 billion, up 154% compared to the same period last year. This figure is 6 times larger than Intel's DCAI revenue, showing NVIDIA's absolute dominance.

Faced with this reality, Intel has chosen a pragmatic strategy with the Gaudi AI Accelerator. Instead of going head-to-head on raw performance, Intel is focusing on price/performance. The Gaudi 3 is priced at about half the price of NVIDIA’s H100 (about $15,625 vs. ~$30,000 per chip). Despite having lower TFLOPS (1835 TFLOPS BF16 for Gaudi 3 vs. 1979 TFLOPS for H100), Intel claims that the Gaudi 3 excels at inference tasks with large token outputs and is 10% to 2.5x more cost-effective. However, this is a risky strategy. Targeting the price-sensitive, well-rounded segment could help Intel generate revenue, but it risks positioning Intel as a second-tier option that is unlikely to disrupt the CUDA software ecosystem and thought leadership that NVIDIA has built over the years.

Semiconductor Foundry Market (vs. TSMC)

On the semiconductor manufacturing front, the gap between Intel and TSMC is widening. In Q2 2024, TSMC reported $20.8 billion in revenue with a gross profit margin of 53.2%. This is in stark contrast to Intel’s 27.5% gross profit margin in Q2 2025. TSMC is mass-producing 3nm and 5nm processes, which account for 50% of total wafer revenue. Meanwhile, Intel is still struggling to bring comparable processes to mass production in a profitable way. Ironically, Intel itself has to outsource some of the key components in its new products to TSMC.

IDM 2.0 future and product roadmap

The 5N4Y roadmap, once a source of pride and strategic focus for Pat Gelsinger, now faces harsh financial realities. While Intel is still reporting technical milestones such as the release of the 18A process design kit (PDK) 1.0 and a successful launch of early products like Panther Lake, bringing these processes to profitable mass production is a different story. The new era under Lip-Bu Tan requires that each process be not only technically successful, but also economically viable.

The strategic shift is most evident in the approach to future processes. Intel’s 18A process is still identified as the foundation for at least the next three generations of client and server products, which are crucial for internal products such as Panther Lake and Clearwater Forest. However, Lip-Bu tan has emphasized that attracting external customers will be easier when Intel brings its own products to scale. This suggests that the priority has shifted to proving capabilities and serving internal needs before venturing outside.

As for Intel 14A, this is where the new doctrine is most thoroughly applied. Intel’s CEO declared emphatically: “Our investment in Intel 14A will be based on confirmed customer commitments. There will be no more blank checks.” Recently, sources said that Intel could cancel the 14A process entirely if it cannot find a major customer to commit to using it. This is essentially an orderly withdrawal from the unconditional process race. Intel is accepting that a nominal lead on paper is meaningless without profitability. By making the future of 14A dependent on customers, Intel is transforming itself from a technology-first company to a market-driven enterprise. This may be the end of its ambition to become the world’s leading foundry in the near future, but it is a business decision that makes sense for survival and stability.